Tangerine Money-Back Credit Card

Tangerine Money-Back Credit Card,这张信用卡还没有开始发行,但是我还是准备先预留好位置,好好写一下这张信用卡。最近是不是和信用卡杆上了,连续更新了NO FOREIGN TRANSACTION FEES的信用卡。我是觉得这张信用卡,我们是可以花时间好好聊聊的。

Tangerine Money-Back Credit Card优点

- 没有年费,没有年费也就意味着你可以无脑申请。

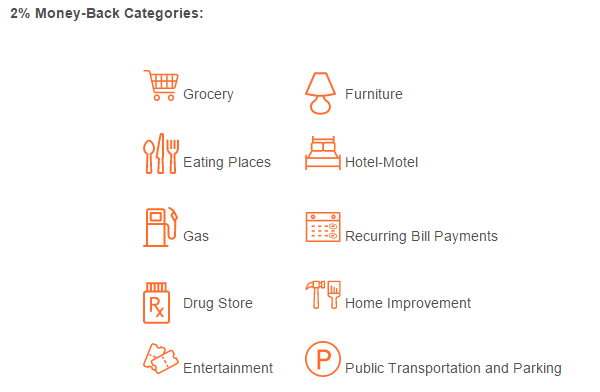

- 你可以选择两个Category有2%的Cash Back,其他的Category 1%的cash back。比如说你是超市和加油的消费比较多的话,你可以选择Grocery 和Gas获得2%的Cash Back,那么其他的所有的消费就只有1%了。如果你选择把Money-Back的钱存入Tangerine Saving account,那么你可以有额外的的一个Category有2%的Cash back, 那么你就有3个 Category可以获得2%的Cash Back. 如果你注册Tangerine Saving Account,还可以获得现金奖励,具体可以看我的另外一篇文章:Tangerine Saving Account具体的Category可以查看下面的表格。

- Purchase protection and extended warranty.

- 1.5% foreign transaction fee,虽然不是no foreign transaction fee,但是总比那些动不动就2%的好。

Rewards Features

- Earn 2% Money-Back Rewards on purchases in two 2% Money-Back Categories of your choice, and 1% Money-Back Rewards on all other purchases.

- Have your Money-Back Rewards deposited into a Tangerine Savings Account, and get a 3rd 2% Money-Back Category.

- Money-Back Rewards are earned automatically and paid monthly, and can either be applied towards your Credit Card balance or redeemed into your Savings Account.

- No limit on the amount of Money-Back Rewards you can earn.

- Change your 2% Money-Back Categories to suit your spending.

- Orange Alerts are emailed to you so that you’re up-to-date on what’s happening in your Account.Additional Card Features

- 1.5% Foreign Conversion Fee – one of the lowest in market

- Free Cards for Authorized Users on your Account

- Purchase Assurance and Extended Warranty1 – For most new purchases made anywhere in the world using your Tangerine Money-Back Credit Card, you may receive a lifetime maximum of up to $60,000 for the following insurance coverage:

Purchase Assurance, which may automatically cover loss, theft or damage, in excess of other insurance, for 90 days from the date of purchase; and

Extended Warranty, which may double the period of repair services, to a maximum of one additional year, when the original manufacturer’s warranty expires.MasterCard Features - Accepted worldwide at more than 24 million locations in over 210 countries

- MasterCard Zero Liability

- MasterCard Tap & Go

Summary

With no fees and no high-income qualification, this card competes primarily with MBNA Smart Cash, AMEX SimplyCash, Capital One Travel Platinum, Amazon.ca Visa and PC Financial MasterCard. I believe that for most people, if you set the 2% categories to gas, groceries, entertainment or restaurants, this card is the winner! Unfortunately, there are no attractive sign-up bonuses like those offered on some of the other cards. It definitely cannibalizes on Scotiabank’s own Momentum products. For students, new grads, first-time credit card applicants and those without 60K in personal income, this is an excellent choice. Unlike Smart Cash, there are no limits to what you can earn and can set an additional 2% earning category with a Tangerine savings account.